Should I get a property survey?

Getting a survey done can be money well spent. Find out why.

Once you’ve had an offer accepted, a survey can help highlight any snags. Here’s why it’s worth the money.

Types of survey

There are several types of survey available when buying a property. These are the four most common:

- HomeBuyers Report

- Condition Report

- RICS Building Survey

- Mortgage Valuation Survey

Here is a snapshot of the types of report, their likely costs and where we think they are most useful:

| Type of report | About the report | When to get this survey |

|---|---|---|

| HomeBuyers Report | A fairly detailed report which should flag repairs and defects that need addressing. It can sometimes include a valuation and reinstatement assessment. This is the most common type of survey. Cost: £600-800 | Suitable for most properties in standard conditions. |

| Condition Report | Overview of the property and its condition. Similar to a Mortgage Valuation Survey but for yourself. Cost: ~£300 | New-build flats or ex- local authority flats in good condition. |

| Full Structural/ RICS Building Survey | Detailed survey looking into defects with the property. Also often includes a valuation and reinstatement assessment. Cost: £1,000-1,800 | Larger freehold properties with obvious signs of problems. |

| Mortgage Valuation Survey | A survey for the bank to make sure the property is suitable security for the loan. Major structural concerns should be flagged. Cost: Varies by lender | Any property you intend to take a mortgage on. |

Continue reading for more detail on all of these.

HomeBuyers Report

A HomeBuyers Report is the type of survey you’re most likely to need. While this type of survey still doesn’t go into huge amounts of detail – it’s not going to investigate beneath the floorboards or go into too much depth about the structure of the property – it can nevertheless raise alarm bells, like suspicions of damp, possible subsidence and whether the plumbing and electrics are likely to be in good condition. A Homebuyers Report that uncovers any sign of a problem will most likely suggest that you employ a further specialist to investigate.

This type of report is only really suitable for properties that seem to be in fairly good condition, or flats in general, where access to common parts like the roof for a full survey cannot be granted. Depending on the level of reassurance you need, and what you spotted in the property on your visit, you may prefer to instruct a few specialists (e.g. a damp specialist), to inspect the property, rather than do a Homebuyers Survey.

Condition Report

Alternatively, a Condition Report is the cheapest option available, but only provides very basic information about the property. It is unlikely to shed any light beyond what you can see yourself in the property. These reports, often referred to as Level 1 surveys, are the same type used for Mortgage Valuation Surveys, but importantly, can also be used by homeowners who just want to know what sort of state their home is in. This type of report is most suitable for new builds and other conventional builds in good condition. It may be a useful extra if your lender chooses to do a desktop valuation rather than an in-person survey.

RICS Building Survey

If you’re buying a house, especially one in less than perfect condition, it would be advisable to obtain a RICS Building Survey, otherwise known as a full structural survey. If you’re buying a listed property, you should consider using a surveyor that specialises in these types of buildings as you will need more detailed guidance.

Full surveys offer a comprehensive overview of the structure and condition of a property. There is little point instructing a surveyor on a Building Survey for a flat as you are unlikely to get the full benefit as they won’t have access to the entire building. Although expensive, it is worth having a survey like this when buying a freehold property, as any problems will land at your feet, so it’s best to know what you’re getting yourself into.

Anything that comes up in a Building Survey is likely to still require further investigation by a specialist, but the surveyor will probably give you some guidance on the likely costs and potential remedies to the problem. If you’re worried about costs, it’s worth remembering that these reports give you excellent information and scope to negotiate a price reduction on reasonable grounds if unexpected problems arise.

Mortgage Valuation Survey

And a quick word on Mortgage Valuation Surveys – if you’re buying with a mortgage, your lender is likely to send round a surveyor to determine if there is anything majorly wrong with the property and to value it for the bank’s purposes. This is a Mortgage Valuation Survey. This may well be sufficient for you if you’re buying a low risk property; examples might include new build flats, or perhaps ex-local authority blocks, assuming in both cases that on your visit the flat appeared to be in good condition.

Why a ‘bad survey’ isn’t always a disaster

It’s worth remembering that most surveys sound extremely gloomy on first reading. Old properties in particular will almost certainly have some issues – no one expects a Victorian terrace to be in the same condition as a new build. But remember, there are many problems that you can happily live alongside for years that will not affect the value. It’s always worth having a call with your surveyor once you receive your report, as they may be able to interpret the report in layman's terms for you, and give you an opinion on whether the problems are sufficiently serious to warrant pulling out of the purchase, or renegotiate the price.

Common problems by property type

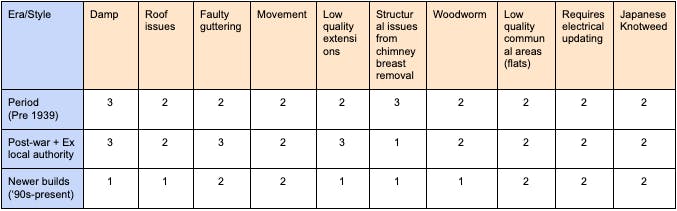

There are a number of things that regularly come up on surveys. It’s worth understanding this before your survey happens so you don’t get a nasty shock. Below are some problems that are typically encountered based on homes from different eras.

1 - Very unusual / Never - Shouldn’t ever be an issue, and can be a serious reason to renegotiate or reconsider the property if brought up by the surveyor

2 - Infrequent - Comes up on occasion, and should be taken into consideration in conjunction with the general condition of the property

3 - Fairly common - Can be expected with properties of this type or age if not properly maintained

A survey is better than a surprise

A survey can provide invaluable peace of mind when you’re looking to make your next move. Read more about getting a survey done when buying a home.